Good morning and welcome to Insider Finance. I'm Dan DeFrancesco, and here's what's on the agenda today:

- JPMorgan just gave retail wealth clients access to cryptocurrency funds – making it the first major US bank to do so.

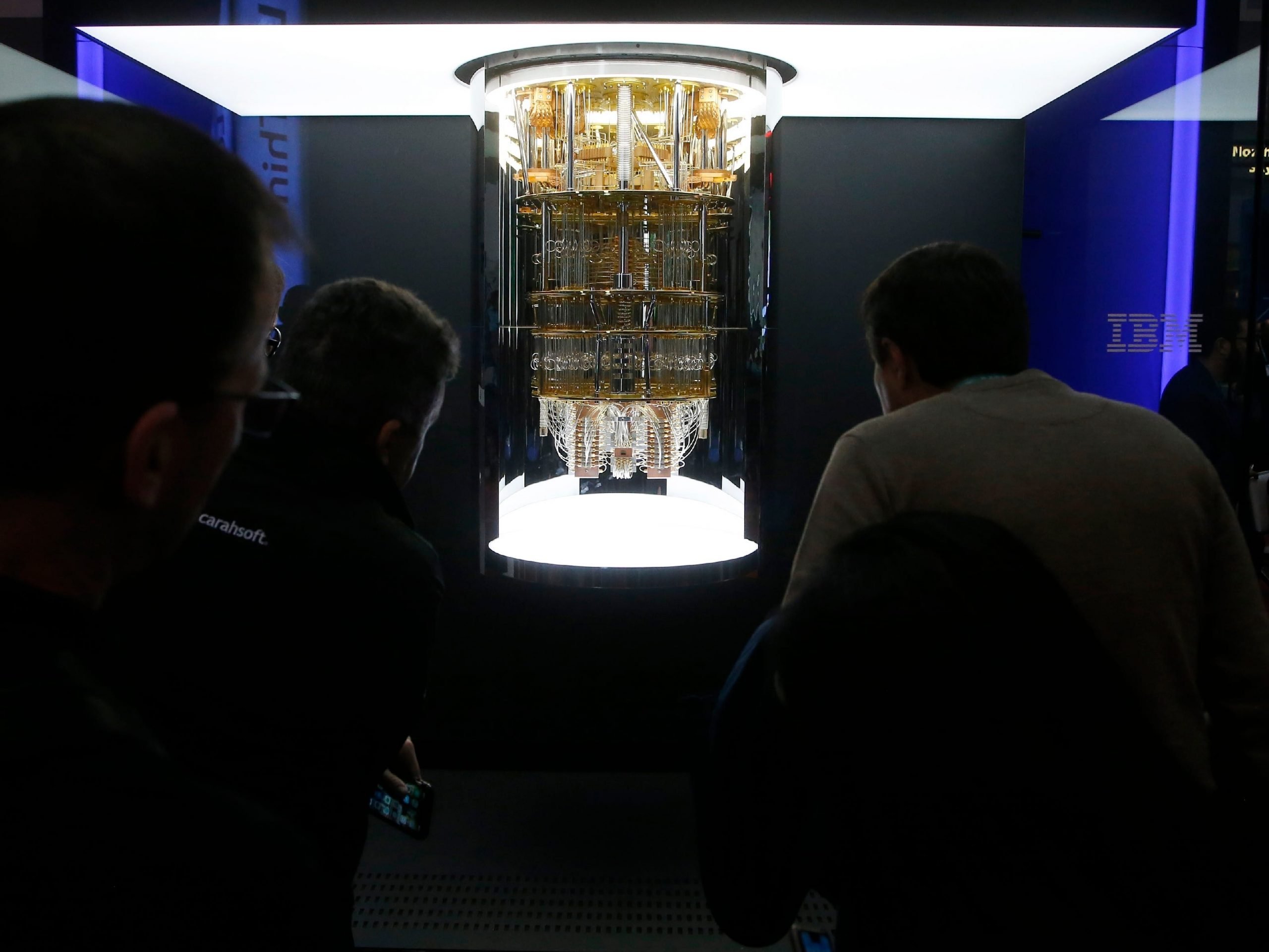

- IBM is trying to bolster Wall Street's access to quantum computing. Here's how.

- Millennium Management is using technology as a key tool for recruitment and retention.

Like the newsletter? Hate the newsletter? Feel free to drop me a line at [email protected] or on Twitter @DanDeFrancesco.

JPMorgan just became the first big bank to give retail wealth clients access to cryptocurrency funds

The bank gave its financial advisors the green light to give all its wealth-management clients access to cryptocurrency funds, making it the first major US bank to do so.

IBM is all in on quantum computing. Here's how it's trying to boost Wall Street's access to the complex tech.

While quantum computing, which can quickly solve complex calculations, is gaining momentum on Wall Street, the tech requires significant resources that hold some firms back from using it. Take a look at how IBM is trying to change that.

JPMorgan is planning to double the size of its financial advisor force to go head-to-head with wealth giants like Merrill Lynch and Morgan Stanley

While the bank is the largest in the US, its wealth business is looking to catch up to bigger rivals. Take an inside look at how it's planning to do just that.

Millennium is using its AWS-hosted cloud tech as a key weapon to attract and retain top portfolio managers

As the war for talent rages among hedge funds, Millennium Management is using technology as a key value prop for recruitment and retention. We spoke with its top cloud exec, who detailed how it's using the tech as a critical tool for recruitment and retention.

Amazon, investment banks, and even big tobacco are spending millions of dollars to try to get favorable marijuana laws

Wall Street analysts say the legal cannabis market could be worth over $100 billion by the end of the decade, and corporations from the medical, consumer, and financial services sectors are clamoring for a slice. Here's what you need to know.

Wells Fargo is staffing up its restaurant finance team ahead of an expected M&A surge

Wells Fargo tapped Meghan Hinds as its new head of restaurant financing, just two months after MUFG nabbed eight bankers from the bank's restaurant team. More on that here.

Family offices' top experts lay out 4 questions that billionaires should ask when deciding to launch a family office

Most advisors agree on a few common questions clients should ask themselves before setting up a single-family office - including how much they're willing to spend. Check out what else to consider before setting up your own shop.

Here's the 11-page pitch deck a blockchain startup looking to revolutionize private-markets investing used to nab $48 million from investors like Morgan Stanley

Securitize, which just raised $48 million from Morgan Stanley, Sumitomo Mitsui Trust Bank, and others, is bringing blockchain technology to the private markets to make investing simpler. See its pitch deck here.

Blackstone's Jon Gray is eyeing hotels as travel recovers, reversing its lowest-ever exposure to tourism-related properties

The Blackstone president wants to increase exposure to hospitality-linked real estate now that vaccinated passengers are returning to the skies. Get the full rundown here.

Odd lots:

How a Black-Owned OCIO More Than Doubled Its Assets in a Year (Institutional Investor)

China Weighs Unprecedented Penalty for Didi After U.S. IPO (Bloomberg)

Wells Fargo Names Derek Ellington Head of Small Business Banking (Business Wire)